sales tax on leased cars in texas

Read real discussions on thousands of. If the lessee is a new resident of this state as described in 371 of this title relating to Definition of Resident and New Resident the new resident may pay a new resident use tax of 90.

2412 Texas Ave S College Station Tx 77840 Loopnet

The sales tax for cars in Texas is 625 of the final sales price.

. Hi in Texas do you have to pay sales tax on a leased vehicle upfront. No tax is due on the lease payments made by the lessee under a lease agreement. Local tax rates range from 0 to 2.

According to the Texas Department of Motor Vehicles any person that buys a car in Texas owes the government a motor vehicle sales tax. A A tax is imposed on every retail sale of every motor vehicle sold in this state. Car youre buying 50000 Car youre trading 30000 Trade Difference 20000 Taxes.

Also no tax is due by the lessee on the purchase of a motor vehicle for lease in Texas. A Except for purchases by franchised. Any tax paid by the.

Except as provided by this chapter the tax is an obligation of and shall be. Motor Vehicles EXEMPT In the state of Texas any leases lasting for greater than one hundred and eighty days are considered to be exempt from the general sales and use tax but will be subject. Texas residents 625 percent of sales price less credit for sales or use taxes paid to other states when bringing a motor vehicle into Texas that was purchased in another state.

The sales tax for cars in. However there may be an extra local or county sales tax added onto the base 625 state tax. In the state of Texas you pay 625 tax on Trade difference Example.

But this is not the case with. In most states sales tax is paid on monthly lease payments not on the total value of the vehicle. Texas collects a 625 state sales tax rate on the purchase of all vehicles.

Hi in Texas do you have to pay sales tax on a leased vehicle upfront. For instance if your monthly payments reach 500 a month for three years and youre required to pay 7 percent sales tax on the vehicles entire value youll end up paying an extra 1260 in. Our Texas lease customer must pay full sales tax of 1875 added to the 30000 cost of his vehicle.

There is a 625 sales tax on the sale of vehicles in Texas. Sales tax is a part of buying and leasing cars in states that charge it. Maybe the philosophy is that the bigger the better.

For vehicles that are being rented or leased see see taxation of leases and rentals.

Virginia Sales Tax On Cars Everything You Need To Know

Do You Have To Pay Taxes On Your Car Every Year Carvana Blog

Used Cars In Texas For Sale Enterprise Car Sales

Used Land Rover For Sale In Weatherford Tx Cargurus

Want An Electric Car But Fear The Cost Here S How To Flick The Switch Motoring The Guardian

What S Due At Lease Signing A Comprehensive Guide Capital Motor Cars

/images/2022/02/08/woman_in_car.jpg)

How To Legally Avoid Paying Sales Tax On A Used Car Financebuzz

Car Tax By State Usa Manual Car Sales Tax Calculator

The Top Is There Sales Tax On A Leased Car In Texas

When Should You Lease Your Car Here S The Best Time To Do It Shift

The Basics Of A Car Lease Agreement Bankrate

As Demand For Cars Falters Auto Prices Are Poised To Fall

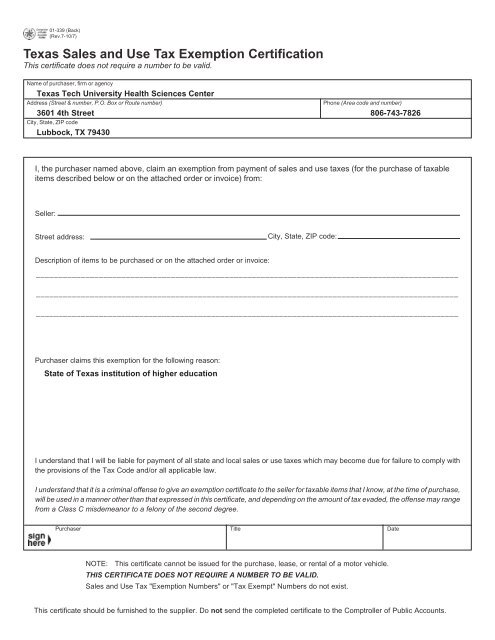

Texas Sales Tax Exemption Certificate From The Texas Human Rights Foundation Unt Digital Library

Texas Vehicle Sales Tax Fees Calculator Find The Best Car Price

Texas Sales And Use Tax Exemption Certification Texas Tech

The Top Is There Sales Tax On A Leased Car In Texas

Used 2019 Kia Forte For Sale In Dallas Tx With Photos Cargurus

Sales Taxes Demystified Your Car Lease Payments Explained Capital Motor Cars