arizona solar tax credit 2022

-- information on claiming credit for investment in qualified small businesses. The Renewable Energy Production tax credit is for a.

Arizona Solar Everything You Need To Know Understand Solar

For commercial installations the installation must have begun before the.

. Individual tax credit for. For most homeowners the ITC can help decrease the cost of a battery by an additional 3000 to 4000. Every resident in Arizona who installs solar panels gets a State Tax Credit of 25 of the total system cost up to 1000 to be used toward.

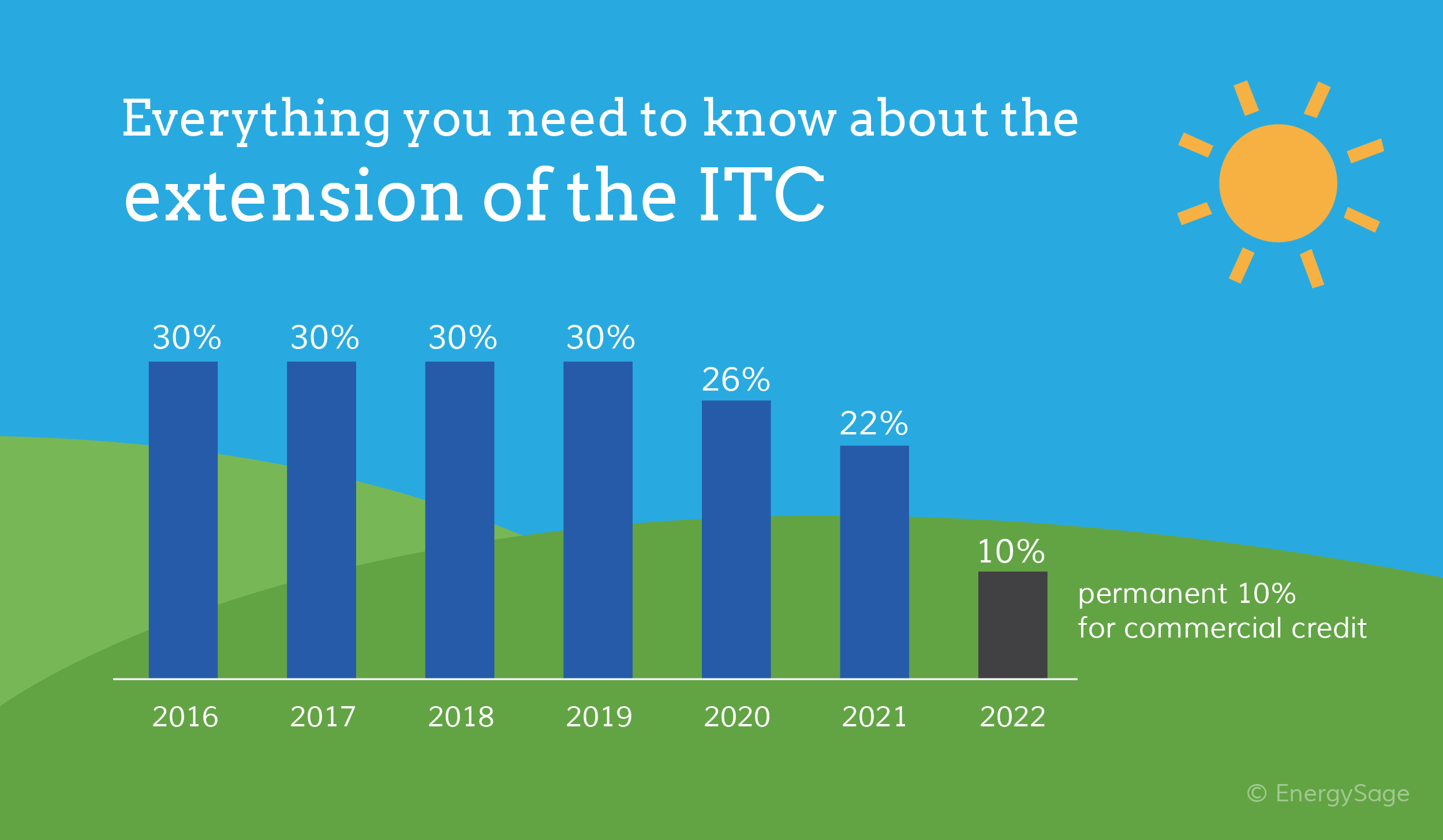

Equipment and property tax. If you use solar to heat your home or water heater instead of using electricity and gas then you can claim 26 percent of the solar system. The Federal solar tax credit allows homeowners to reduce 26 of the total costs related to their solar installation from what they owe on their federal taxes due.

2022s Top Solar Power Companies. Property tax exemption on the added home. Arizona Credit for Solar Hot Water Heater Plumbing Stub Out and Electric Vehicle Charging Station Outlet.

If another device is installed in a later year the cumulative credit cannot exceed 1000 for the same residence. A qualified energy generator is a facility that has at least 5 megawatts or 5000 kW generating capacity located on land in Arizona that is owned. An individual or corporate income tax credit is available for taxpayers who own a qualified energy generator that first produces electricity before Jan.

Summary of Arizona solar incentives 2022. 23 rows Did you install solar panels on your house. The Residential Arizona Solar Tax Credit reimburses you 25 percent of the cost of your solar panels up to 1000 right off of your personal income tax in the year you install the system.

The Arizona tax credit for solar panels is 25 of your system costs or 1000 whichever amount is less. Individual states may also offer incentives such as performance-based incentives incentives that pay cash to solar owners for a number of kW generated by a solar system and cash rebates. Arizona law provides a solar energy credit for buying and installing a solar energy device at 25 25 of the cost including installation.

Importantly standalone storage is not currently eligible for this tax credit. 1 2021 using a qualified energy resource. The state tax credit is valued at 25 of the total system cost up to a maximum of 1000 in total.

Income tax credits are equal to 30 or 35 of the investment amount and are claimed over a three year period. Varies by provider and subject to change without notice. However there is also a specific Arizona solar tax credit that can be combined with the nationwide benefit and it gets deducted from your state income taxes.

Incentives for homeowners to make the switch to solar have historically been offered at the federal state and local Arizona utilities levels. Here are the specifics. Just because of this fact alone you can save a lot of money here with solar.

The 26 federal solar tax credit is available for purchased home solar systems installed by December 31 2022. There are several Arizona solar tax credits and exemptions that can help you go solar. State of Arizona Tax Credit.

Arizona is one of the sunniest states in the country. 1000 personal income tax reduction 6. Ad A Comparison List Of Top Solar Power Companies Side By Side.

Arizona solar tax credit. The solar investment tax credit is a dollar-for-dollar reduction in the amount of taxes you owe. Solar Incentives At A Glance.

In addition to the Federal ITC most Arizona residents are eligible for the state solar tax credit. Federal Investment Tax Credit ITC. 026 18000 - 1000 4420.

The federal ITC is eliminated for residential solar installations after 2023 but commercial solar energy system owners can still deduct 10 percent of a commercial solar system cost from their taxes beyond 2023. Those who are eligible may claim the credit for up to five tax years but the amount of the credit cannot exceed 1000 total. According to recent data a 5 kilowatts kW solar installation in Arizona averages between 12495 and 16905 in cost with an average gross price of 14700.

Arizona Solar Tax Credit In Arizona you can claim up to 1000 in tax credits for switching to solar energy. This estimate might initially sound daunting to your wallet but the good news is that 2021 offers plenty of opportunities to save on your solar investment. Find The Best Option.

The tax credit remains at 30 percent of the cost of the system. This means that in 2017 you can still get a major discounted price for your solar panel system. According to our market research and data from top solar brands the average cost.

The Arizona Commerce Authority ACA administers the Qualified Small Business Capital Investment program. Arizonas Tax Incentives and Solar Rebate Programs. Owners of new residential and commercial solar can deduct 26 percent of the cost of the system from their taxes.

Using the federal investment tax credit ITC you can claim up to 26 percent of the cost of your solar battery as a credit towards your federal taxes. For example if your solar PV system was installed before December 31 2022 cost 18000 and your utility gave you a one-time rebate of 1000 for installing the system your tax credit would be calculated as follows. Residential Arizona solar tax credit.

The solar energy systems that qualify for a 26 tax credit must be placed into service by December 31 2022. Arizona law provides a solar energy credit for buying and installing a solar energy device at 25 25 of the cost including installation or 1000 whichever is less. Read User Reviews See Our 1 Pick.

Until the end of 2022 homeowners can get a tax credit that is 26 of the cost of their solar panels. This incentive reimburses 25 of your. This 75 credit is provided for in Arizona Revised Statutes 43-1090 and 43-1176 and is a nonrefundable individual and corporate income tax credits for the installation of solar hot water heater plumbing stub outs and electric vehicle recharge outlets in houses or dwelling.

But in order to qualify for that 26 your solar installation must be installed before by December 31 2022. The 25 state solar tax credit is available for purchased home solar systems in Arizona. This advantageous incentive lasts until the end of 2022 - the tax credit amount steps down to 22 percent for 2023.

How To Take Advantage Of Solar Tax Credits Earth911

2022 Arizona Solar Incentives Tax Credits Rebates And More

Income Tax Credit For Residential Solar Devices Arizona Department Of Revenue Prescott Enews

Arizona Solar Incentives And Rebates 2022 Solar Metric

Free Solar Panels Arizona What S The Catch How To Get

2022 Massachusetts Solar Incentives Tax Credits

Arizona Solar Tax Credits And Incentives Guide 2022

Why 2022 Is The Year To Go Solar In Arizona Southface Solar

2022 Arizona Solar Incentives Tax Credits Rebates And More

Federal Solar Tax Credit A Homeowner S Guide 2022 Updated

Texas Solar Incentives And Rebates Available In 2022 Palmetto

Federal Solar Tax Credit A Homeowner S Guide 2022 Updated

Solar Tax Credit Pays For Solar Yuma Solar Pros 48solar

Pricing Incentives Guide To Solar Panels In Arizona 2022 Forbes Home

How To Take Advantage Of Solar Tax Credits Earth911

Arizona Solar Incentives Arizona Solar Rebates Tax Credits